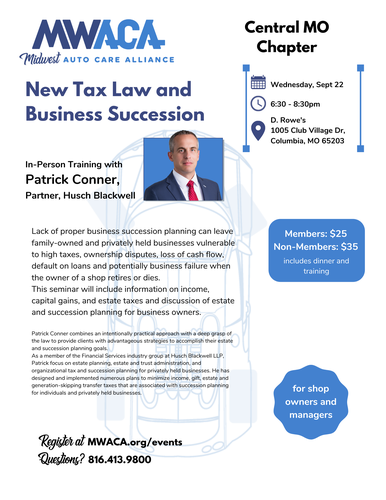

Central MO Chapter Meeting - New Tax Law and Business Succession

Date and Time

Wednesday Sep 22, 2021

6:30 PM - 8:30 PM CDT

Location

D. Rowe's

1005 Club Village Dr.

Columbia, MO 65203

Fees/Admission

Members - $25

Non-Members - $35

Website

Contact Information

Jessalyn Kincaid

Send Email

Description

in-person training with

Patrick Conner

Partner, Husch Blackwell

Lack of proper business succession planning can leave family-owned and privately held businesses vulnerable to high taxes, ownership disputes, loss of cash flow, default on loans and potentially business failure when the owner of a shop retires or dies.

This seminar will include information on income, capital gains, and estate taxes and discussion of estate and succession planning for business owners.

Patrick Conner combines an intentionally practical approach with a deep grasp of the law to provide clients with advantageous strategies to accomplish their estate and succession planning goals.

As a member of the Financial Services industry group at Husch Blackwell LLP, Patrick focus on estate planning, estate and trust administration, and organizational tax and succession planning for privately held businesses. He has designed and implemented numerous plans to minimize income, gift, estate and generation-skipping transfer taxes that are associated with succession planning for individuals and privately held businesses.

Printed courtesy of www.mwaca.org – Contact the Midwest Auto Care Alliance - MWACA for more information.

5950 North Oak Trafficway, Gladstone, MO 64118 – (816) 413-9800 – info@mwaca.org